Since the inception of CXM Group in 2015, CXM has been operating steadily for many years without a single customer fund security incident. The security of customers’ funds is regarded as the paramount priority of CXM. Customer Funds safety is a multi-faceted objective, which includes cutting-edge technological and cyber security tools, payment and transaction channels security, liquidity risk management, segregation of customer funds, strict operational and procedural controls and so on.

FAQ

Find answers to the most popular questions regarding trading with CXM.

About Company

Are CXM funds safe?

How to contact CXM customer service?

You can contact customer service by sending an email to support@cxmtrading.com

Is CXM an STP or a market maker platform?

As a pure STP/ECN platform, our technology, liquidity and execution framework is designed to enable all customer orders to enter the market. We do not engage in betting against our customers. Supplemented by a powerful global and regional data center network with dedicated high speed internet lines, customer orders are directly cleared with the world's major liquidity pools (LPs), including prime brokers, bank and non-bank bank-level LPs.

What are the specific service hours of CXM customer service?

Working hours: 7:00-22:00 Beijing time, outside of holidays, which are announced separately.

When was CXM established?

CXM was founded in 2015 by a group of Wall Street traders and senior executives with decades of experience in the industry. The executive team comes from all over the world, including the United States, Asia Pacific, Eastern Europe, the Middle East and Latin America. Our strength lies in providing diverse solutions to meet the diverse needs of our customers and partners.

Where is CXM from?

The CXM Group includes brokerage entities authorized and regulated in multiple jurisdictions, including among others CXM Direct Ltd (SVG), CXM Prime (UK), CXM Global (MU), CXM Trading LLC (SVG). Among them, CXM Trading LLC (SVG) is committed to all commercial activities that are not prohibited in the St. Vincent and the Grenadines 2009 Amendment Act (Amendment Act Chapter 149), including but not limited to business, finance, leasing, and transaction services. and other brokerage and training services such as providing foreign exchange, commodities, indices, CFDs, and leveraged financial products. CXM Trading LLC has its registered office at Suite 305, Griffith Corporate Center, Beachmont Kingstown, Saint Vincent and the Grenadines (Company Number: 24912 IBC). CXM Prime Ltd is a company registered in England and Wales with company number 13407617 and is regulated by the UK Financial Conduct Authority (FCA) with regulatory number 966753. The registered address is Office No. 518 Signature by Regus, 15 St Helen's Place, London, EC3A 6DQ, United Kingdom.

Which countries does CXM Trading not accept customers from?

Currently CXM Trading does not provide services to the United States, Canada, the United Kingdom, Sudan, Syria, Iran, North Korea, Russia, Belarus, and Ukraine.

Which regulatory jurisdictions do CXM Group of companies operate in?

CXM Group has multiple operating entities, among which CXM Prime Ltd (UK) is regulated by the Financial Conduct Authority (FRN 966753), CXM Global is regulated by the Financial Service Commission of Mauritius (GB21026337), CXM Trading LLC and CXM Direct LLC are operating within the legal scope of business activities as defined in the St. Vincent and the Grenadines 2009 Amendment Act (Amendment Act Chapter 149).

Account Registration

How long does it take to successfully open an account?

10 minu·····tes-30 minutes

How to change my CRM backend password?

Log in to the backend website and select Forgot Password to reset the backend password yourself?

How to change my email address and registered mobile phone number?

Log in to the backend and choose to change customer information or contact customer service to change registration information.

How to open a Live Trading account with CXM?

For new customers, please contact one of our Account Executives or contact CXM official support support@cxmtrading.com

How to reset my CRM backend password?

Log in to the backend website and select Forgot Password to reset the backend password yourself?

How to solve the error message that this email address has been registered?

Please change your email address to register, or contact your account manager to check whether your email address has been registered.

How to solve the problem of incorrect registration information?

Log in to the backend and choose to change customer information or contact customer service to change registration information.

What is the verification code for registering an account?

For account security reasons, customers are asked to check their registered email and manually enter the verification code provided in the email to confirm their email address.

Depost&Withdrawals

Are there any fees for internal transfers?

No

Are there any handling fees for deposits and withdrawals?

There are no additional handling fees for depositing and withdrawaling money into CXM.

Are there any restrictions on internal transfers?

Funds from personal trading accounts cannot be transferred to wallets, and funds from accounts with different names cannot be transferred internally.

Can I cancel a withdrawal application that has been submitted?

Yes, you can cancel it yourself in the Member Area, or you can contact your account manager to send an email application.

Can I deposit money into an account with a different name?

CXM does not process 3rd party deposits/withdrawals

Can I withdraw money if I still have a position?

You can also withdraw the amount of free margin capital not tied up by the open position. If you would like to withdraw the full amount, you need to first close the position and then apply for the withdrawal

How do I check the current processing status of deposits and withdrawals?

Log in to the Member Area → select funds → select transaction records to view the status bar

How is the deposit and withdrawal exchange rate set?

The deposit and withdrawal exchange rate depends on the real-time exchange rate provided by the payment channel

How long does it take for internal transfers to arrive?

Internal transfers are instant

How long does it take for the deposit to arrive?

CXM automatically confirms the arrival of your funds for the system. Once the payment channel confirms that the payment is successful, your funds can be immediately transferred to your account. In order to ensure the speed of your funds arriving into your account, please strictly follow the prompts and requirements of each payment channel.

How long does it take for the withdrawal to arrive?

For withdrawals of less than $50,000 USD, the normal processing time is 1 to 2 business days. It takes 3 to 5 business days for orders greater than 50,000 USD.

How much capital is required to open a CXM account?

No initial capital is required to open an account.

How to perform internal transfers in trading accounts?

Log in to the Member Area→Funds→Transfer funds to operate the transfer by yourself

If my account currently has a negative balance, can I deposit money?

No, please contact your account manager first to apply for clearing the negative balance.

What are the reasons why a deposit can be rejected or canceled?

The customer did not pay the funds in time, did not pay according to the actual amount of the deposit order (underpayment or overpayment resulted in automatic payment), and did not confirm on the last step with the paid button after the payment was completed.

What are the reasons why withdrawals can be rejected?

If the bank information or personal information filled in for the withdrawal is incorrect, or the bank card exceeds the limit, the withdrawal will fail and will be automatically returned by the system with a rejection status.

What are the ways to withdraw money?

Follow the principle of enter/exit through the same channel. If deposit came in through UnionPay, then UnionPay must be used for withdrawals. If deposit came in through digital currency, then it must be withdrawn the same way.

What currencies does CXM accept for deposits?

We only support UnionPay deposits and digital currency deposits (TRC20 and ERC20)

What deposit and withdrawal methods does CXM provide?

UnionPay deposits and withdrawals, digital currency deposits and withdrawals (TRC20 and ERC20 channels)

When will the deposit arrive during Saturdays, Sundays and holidays?

UnionPay deposits are automatically confirmed by the system. Once the payment channel confirms that the payment is successful, your funds can be credited immediately. Cryptocurrency deposit support will be processed as soon as possible after being online.

Most Frequently

How to reset my Member Area password?

Log in to the backend website and select “Forgot Password” to reset the Member Area password yourself.

What are the deposit and withdrawal methods of CXM Trading?

UnionPay deposits and withdrawals, digital currency deposits and withdrawals (USDT in TRC20 and ERC20 formats)

What is the minimum deposit required to open a CXM Trading account?

$500 USD

What is the MT4 server name of CXM Trading?

CXM Trading MT4 server names start with “CXMTradingLtd-Real”

Why can’t I log in to my MT4 trading account?

Please confirm that the account, password and server information you selected are correct. It is also recommended that you copy and paste the password instead of entering it manually. When copying, please be sure to select only the password character area and do not copy it into the space area.

MT4 Q&A

How to change the MT4 chart time?

Added histogram time period options in the menu bar, select "Display">"Toolbar">Period, and you can select the following time period price charts. M1=1 minute chart, M5=5 minute chart, M15=15 minute chart, M30=30 minute chart, H1=1 hour chart, H4=4 hour chart, D1= one day chart, W1= one week chart, MN=one Month chart.

How to display all available trading symbols inside a platform?

In the "Market Watch" window, right-click and select "Show All" to view all trading varieties.

How to display icon histogram?

In the menu bar, select Chart > Bar Chart, you can also use the shortcut key (Alt+1)

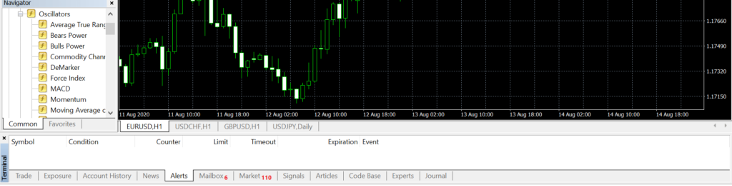

How to insert technical indicators into MT4 charts?

Select "Insert">Technical Indicator in the top menu bar. You can also select and insert the corresponding technical indicator in the "Navigation" bar.

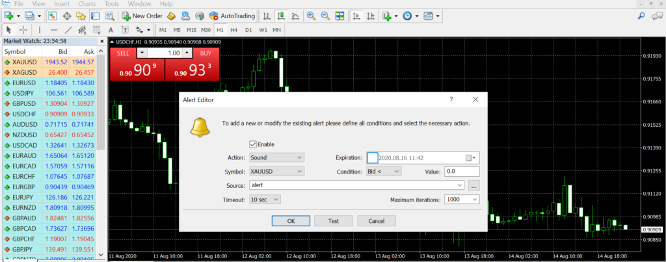

How to set a reminder?

Setting up price alerts is easy. Press CTRL+T on your keyboard and select the Reminders tab to open the terminal window at the bottom of the screen.

You can set a price alert in the alert editor window that appears by right-clicking within this window and selecting "Create" on the menu.

How to view transaction history and download transaction reports?

Transaction history can be found in the Account History tab of the Terminal window, right-click and select Options to select your date range: All History, Last Three Months, Last Month, or a Custom Period.

To download your transaction report, you need to open a terminal window and select the Account History tab to generate a transaction report. Right-click the window and select Save As Detailed Report or Save As Report.

PAMM

How does an asset manager check the funds and positions of sub-accounts?

Since PAMM only opens the main MT4 trading account for asset manager, the main account only displays the overall funds and positions. Asset manager cannot see the position status of each sub-account in real time through the MT4 software.

How to check the account funds and positions in the asset management sub-account?

You can query asset management order position information in the trading section.

What are the requirements for setting the forced liquidation line for PAMM accounts?

The main account does not have this setting. Only investors have this setting for their own investments. Please refer to the investor registration guide.

Social Trading

Can an account type different from the Provider be followed?

Yes, It can

How to understand the Performance Fee settlement cycle?

Fee settlement periods are set to the intervals in the guide – performance fee periods, divided into “per transaction”, “daily”, “weekly” and “monthly”.

The "per transaction" basis method is when the performance fee is distributed from each profitable order, and there is no adjustment or reduction for loss orders.

The "Daily", "Weekly" and "Monthly" Performance Fee distribution methods are as follows: the net profit value is calculated within the set period to distribute profit share, that is, total profit - total loss = net profit x performance fee ratio = Performance Fee amount.

Using the periodic settlement method involves the risk of customers withdrawing funds in advance. Since the system cannot restrict the flow of funds in the follower's account in any way during the period of copying services, customers can withdraw funds at any time or transfer funds to other accounts. When fees are settled, (Settlement due to maturity or early termination of the copy by the customer) The account does not have enough funds to deduct, resulting in the risk that the signal provider cannot receive the fee. Our company does not impose any withdrawal restrictions on the followers. Therefore Providers need to take this risk into account when selecting the Performance Fee settlement type. It is recommended to use "Per Transaction" settlement type.

The return calculation method

The calculation method is time-weighted Rate of Return (TWR) calculation method also called a geometric mean return: https://www.investopedia.com/terms/t/time-weightedror.asp

Currently, our official website displays the rate of return for all time, which is the current rate of return from the time the trading account was created until now.Current rate of return = ((Previous rate of return/100 +1)*(Hourly rate of return/100 +1)-1)*100

Why can’t I find the main account ranking page of the CXM documentary system strategy?

If the return rate of the provider's trading account is below -85%, the system will automatically hide the account from the ranking list.

Trading Related Q&A

Are Expert Advisors allowed?

Yes.

Are hedging transactions allowed?

Yes.

How is the quality of CXM order execution?

CXM Trading strictly implements the best transaction execution policy. In 2023, 97% of orders were executed at requested Price or Better, setting an excellent benchmark in the industry. With an institutional pedigree, CXM Trading has invested heavily in trading and network infrastructure to ensure it meets the needs of the most demanding professional traders. CXM Trading takes pride in the quality of its trade execution and continually strives to further improve it. The average execution speed in 2023 was 63 milliseconds, consistent with the 2022 data.

How many accounts with the same name can I open at the same time?

6

How to add a new trading account?

Log in to the Member Area → open a real account, please refer to "CXM Customer Account Opening Process" Manual

How to open different account types?

Log in to the Member Area → open a real account → select account type (if you cannot choose, please contact the account manager to add the account type group)

Is high-frequency trading allowed?

Yes. Please refer to the "CXM Liquidity Guide" for the minimum allowed holding time.

Is scalping allowed?

Yes, please refer to the "CXM Liquidity Guidelines" for the minimum allowed holding time.

What is CXM’s most popular product?

Gold as CXM's most popular product depends on CXM to provide the best gold spreads, deepest liquidity and best-in-class trade execution in the market. CXM Group is rooted in the institutional market, carefully selects and continuously optimizes its gold liquidity providers (LP), thereby reducing comprehensive transaction costs and improving our customers’ overall trading experience. Unlike many other brokers, our gold spreads are consistent. CXM has multiple liquidity tiers to offer competitive pricing even for large trades. Our gold market depth is up to 7,500 ounces per click and customized bespoke price feeds can be tailored for institutional-level clients.

Thanks to smart order routing algorithms and a strong pool of liquidity providers, CXM Trading achieved an almost perfectly balance distribution ration between positive (3.16%) and negative slippage (3.25%) across all executed orders in 2023. In 2023, orders executed At the requested Price or Better accounted for 96.75% of total orders.

What is my trading leverage on CXM?

Different deposit amounts have different leverage, and the maximum leverage of CXM is 1:1000. Please refer to the CXM leverage policy for details as follows:

What is the liquidation Stop-Out ratio of CXM trading accounts?

CXM Stop-Out ratio is 50%

What is the minimum deposit for an account to start trading?

$500 USD

What trading products does CXM provide?

CXM offers 63 foreign exchange products, 3 precious metals, 5 base metals, 15 stock market index products, 3 energy products, 60 cryptocurrency products, and 135 international stocks.