CXM Trading PAMM

Percentage Allocation Management Module, also known as PAMM, is a trading model where Investors invest their money into an experienced trader or Money Manager with the expectation of getting profit from the MM’s trading strategy.

PAMM Account features

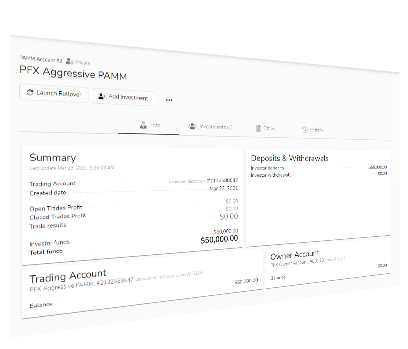

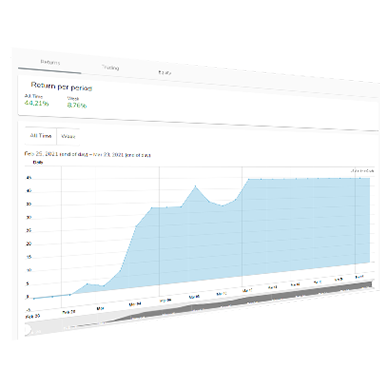

Innovative and advanced live reports and statistics including:

- Historical chart of the used leverage

- Daily Return Volatility

- Recovery factor

- Return geometric average

- Sharpe ratio and much more

Benefits of CXM Trading’s PAMM for Investors

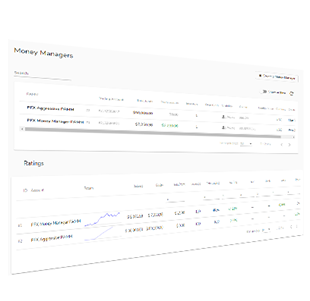

Investors can see both the historic performance on closed positions as well as profits on any open position and can compare PAMM Managers performance in PAMM Ratings Page.

Investors can earn passive income by taking advantage of the best strategies shared by Managers on our Social PAMM page, while keeping full control of their own accounts.

Investors can join the PAMM at any day and can leave PAMM at any time.

Investors can autonomously choose which PAMM to join, Managers can set flexible fees structures (“offers”).

Investors can set the minimal value of the investment to trigger the auto-close.

It is based on an online platform, no software needs to be installed.

Opening a PAMM account with CXM Trading

Benefits of CXM Trading’s PAMM for Money Managers

Traders can build a certified track record that could be the first step on their career path as a professional Money Manager.

Money Managers can control multiple PAMM accounts from one access point and enabling you to run different investment strategies at the same time.

Money Managers can enjoy highly user friendly Management Portal functionality with full view of all Investor Accounts.

Our PAMM is designed to support virtually any combination of the fees, thus meeting the needs of most complex PAMM structures.

Separate automated functionality for Fund Raisers that work together with PAMM Money Manager lets you focus on trading while taking care of the administrative process in the back ground.

The system is safe for Managers as the strategy intellectual property is protected (Investors cannot reverse engineer it).

PAMM works by post-trade allocation into all Investor Accounts, therefore ensuring same time and same price order entry and exit, as long as Investors accounts are in the same account groups.

For those money managers who use a progressive scale for performance fees our PAMM system can support variable performance fee based on the actual PAMM profitability.